Upromise Review

Upromise offers a unique way to save cashback rewards. While many cashback sites encourage spending your rewards on more purchases, Upromise takes a different track. As you can transfer your rewards to 529 college savings, you can further maximize your savings growth potential. Another notable feature that it offers the ability to add someone else’s 529 plan to your account.

Pros

- Has an automatic fund transfer feature

- Add money to your 529 College Savings Plan

- Add 529 College Savings Plan of others

- Variety of ways to get cashback

Cons

- Min transfer threshold starts at $10

- Browser extension is limited to Chrome

Compare to Other Cashback Sites

Swagbucks

18 ways to earn money – surveys, coupons, cashbacks + $5 sign up bonus

Up to 10% cashback from stores – Walmart, Amazon, Best Buy, JCPenney

Most members can earn an extra $50 – $200 a month using Swagbucks

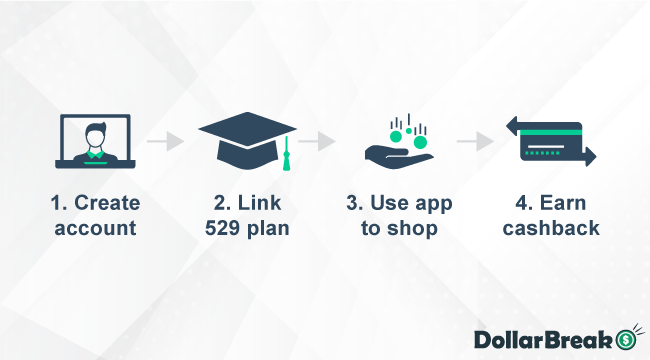

How Does Upromise Work?

Upromise is a Massachusetts-based company that offers a savings and rewards program to its members. It was launched in 2000 as a subsidiary of Sallie Mae, a loan company. In 2020, the company was acquired by Prodege.

Upromise offers its cashback services through its website or app. Like other places that give cashback, you’ll need to create an account with them and link your 529 plan. If you have a savings or checking account to link, that also works.

From there, you can access several ways to earn cashback. These include using the app or website to shop on its online mall where you’ll find their partner retailers.

You can also link a debit or credit card to your account and use them to pay for your restaurant bill. Suppose you have a Upromise MasterCard. In that case, you can receive cashback when you pay for your purchases using the card.

Your cashback from these transactions goes to your Upromise account. If you have a linked checking, saving or 529 College Savings Plan account, you can set Upromise to automatically transfer your account there.

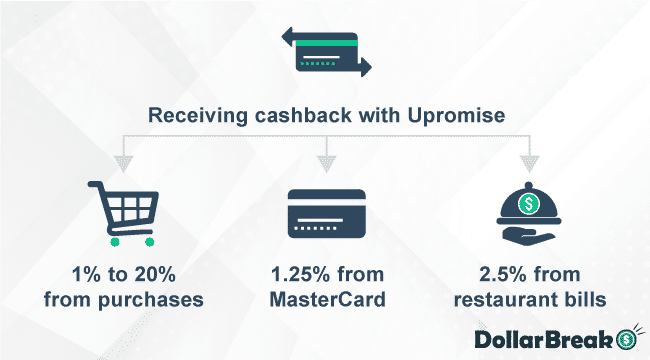

How Much Cashback You Can Get With Upromise?

According to a Upromise blog, you can get 1% to 20% cashback from your purchases. However, your cashback still depends on your purchases and the methods you used to get cashback.

Suppose you use the Upromise MasterCard and link an eligible College Savings Plan to your Upromise account. When you pay for your purchase using that MasterCard, you can get around 1.529% in cashback.

On the contrary, you can earn around 1.25% cashback using the MasterCard if you don’t link a college savings plan.

Also note that when you purchase using the card, Upromise rounds up the total amount to the nearest dollar. This way, you get higher cashback rewards.

Restaurants purchases offer higher cashback, set at 2.5% of your total bill, and includes tax, tip, and drinks. If you pay with a Upromise MasterCard, you can get up to 5% back.

Who is Upromise Best for?

Upromise is a promising app for those looking to save money for their college education. After all, you can link your 529 college savings plan account and set your cashback to automatically go there.

Even if you’re not saving for college, you can still use Upromise. This cashback website also allows you to link a checking or savings account. You can also get your cashback straight there.

Upromise became one of the top cashback sites these days for allowing people to link 529 accounts of other people. Then, they can also set their cashback to automatically transfer to the linked 529 accounts, even if those aren’t theirs.

This is a feature family and friends can use to help loved ones save for their college funds. If you have family members saving money for whatever reason, you can also share your cashback with them, too.

Upromise Partner Stores

Upromise partners with over 10,000 brands and you can search the website for these based on categories. To give you an idea, here are some:

| Department Stores | Food and Beverage | Travel and Vacations |

|---|---|---|

| Walmart | illy | Agoda |

| eBay | DoorDash | Uber |

| Macy’s | Chicago Steak Company | American Tourister |

| Harvey Nichols | Etude Wines | British Airways |

| Kohl’s | Buffalo Wild Wings | Hilton |

| Sears | Beringer | Klook |

| Marks & Spencer | Blue Apron | Qatar Airways |

| Neiman Marcus | Chateau St. Jean | Samsonite |

| Nordstrom | Drizly | Trip.com |

Upromise Features: What Does Upromise Offer?

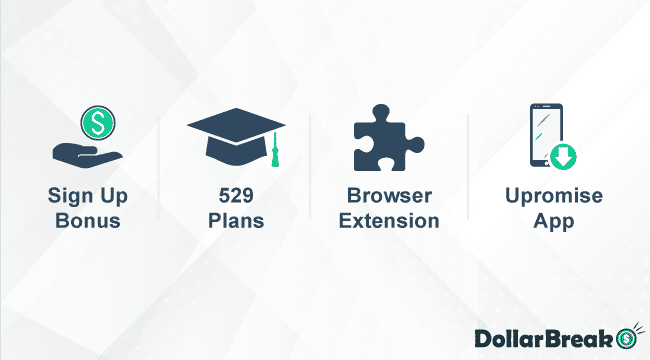

Sign Up Bonus

You can get up to a $30.29 signup bonus on the platform. Upromise gives the $5.29 initially after you verify your email account. Then, you’ll get the next $25 after linking a 529 College Savings Plan.

529 Plans

As its mission is to help families save money for college education, you can add 529 College Savings plans to their Upromise accounts. This allows you to set your cashback to automatically transfer to your 529 accounts.

By doing so, you can maximize the earnings growth of your funds. Upromise estimates that a $10 monthly cashback can help you get an additional $3,500 on your 529 after a 5% interest in 18 years.

Fortunately, Upromise considers all 529 College Savings Plans eligible. In some rare cases, users are unable to locate their 529 plans on the list. For such, users can contact their plan administrator for the plan name and other relevant details.

What’s also great about this feature is that you can link another person’s 529 college savings plan. Also, you can add multiple 529 plans to your account.

Upromise Browser Extension

The Upromise extension is a browser extension you can use to shop online. To install the Upromise extension, make sure you’re using the Chrome browser. Then download and install the extension from the Upromise website.

The browser only works with desktop browsers, not on smartphones. When it works on your computer, it alerts you when you’re on a partner retailer website. Thus, you’ll know when there are available cashback offers and coupons and claim those.

Upromise App

Upromise also gives out cashback through its app, which you can get from Google Play Store or the Apple App Store. You can use this to shop online and get cashback rewards.

This app also allows you to claim cashback rewards by uploading a photo of your receipts. How this works is quite similar to other cashback online shopping apps.

You need to select featured products to your list and make sure to add the correct quantity. After purchasing these items, you can submit your store receipt by taking a photo and uploading it through the app.

Note that you’ll need to submit the receipts under “Any Receipt” offers. Also, the receipt must be 10 days old at most.

Is Upromise Free?

Yes, creating a Upromise is account is free. So is downloading and installing the browser extension and app.

Upromise Payout Terms and Options?

All your cashback reward stays on your Upromise account unless you transfer it to your linked savings, checking, or 529 accounts. You’ll need to meet the minimum transfer requirement to transfer your rewards.

The minimum transfer requirement depends on how many accounts you linked and the type of these accounts. To give you an idea, one 529 college savings plan to your account has a minimum transfer requirement of $50.

If you have either a checking or a savings account linked, the minimum threshold is $10. For those with multiple accounts added and have 529 plans included, the minimum transfer requirement is $50.

These requirements also apply when you opt for the automatic transfer feature in your Upromise account. Automatic transfers are processed every first week of the month that you meet the minimum requirements.

Upromise Reviews: Is Upromise Legit?

Upromise offers an innovative, safe, and legitimate way to grow your savings. The company has received a 4.5 Trustpilot rating.

Users like how the platform is easy to use and truly helps them save money for their college education. Others also complimented the variety of ways they can get cashback for their purchases.

Meanwhile, few users experienced having issues with their accounts getting deactivated. Others also expressed facing problems with activating their Upromise MasterCard.

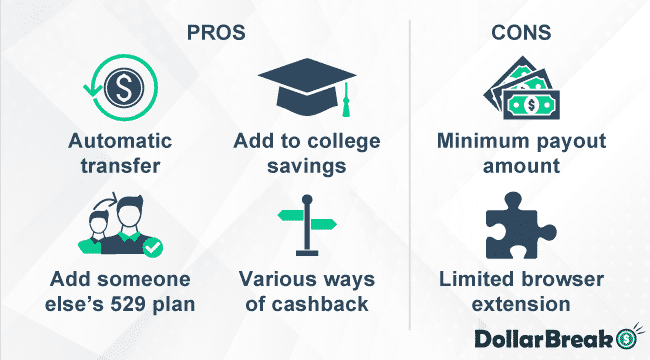

What Are the Upromise Pros & Cons?

Upromise Pros

- Has an automatic fund transfer feature

- Lets you add money to your 529 College Savings Plan

- Lets you add 529 College Savings Plan of other people besides your own

- Variety of ways to get cashback

Upromise Cons

- Minimum transfer threshold starting at $10

- Upromise browser extension is limited to Chrome only

How Good is Upromise Support?

Upromise offers excellent support to its users. Going through its website support page, you’ll find knowledge-based articles to help you understand the platform.

When it comes to how-to articles, you’ll find photos to better guide you as you follow steps. There’s also a chatbot to help you look for any relevant information on the website or submit a support ticket.

It also connects you to a live chat agent, available Monday to Friday, 9 AM to 5 PM PST. If you prefer to call support, you can reach them at (800)-587-7309, the same availability as the chat support.

Upromise Review Verdict: Is Upromise Worth it?

Upromise offers a unique way to save cashback rewards. While many cashback sites encourage spending your rewards on more purchases, Upromise takes a different track.

As you can transfer your rewards to 529 college savings, you can further maximize your savings growth potential.

In a way, this particular feature can help you reach your financial goals sooner. After all, you’re technically putting more money into your savings account. And, you can also save money for other things, since you can link a savings or checking account.

Another notable feature that this money-back website offers is the ability to add someone else’s 529 plans to your account. Upromise attracts families, particularly parents and grandparents, to fund their children and grandchildren’s higher education.

How to Sign Up With Upromise?

To sign up with Upromise, simply go to the Upromise website and click “Join Now.” Enter your active email address and preferred password to proceed.

You’ll receive a verification message in your email so make sure to check that. Once your email address is verified, you can link your 529, checking, or savings account.

Upromise FAQ

What is Upromise?

The company aims to help families save for higher education. It does so by partnering with businesses, such as local restaurants and major retailers.

When members make purchases from these partners, Upromise gives them cashback, which goes to their Upromise account. According to its website, Upromise has helped families save over $1 billion for college education.

Where is my Upromise money?

You can view your rewards on your Upromise account home screen, under Summary Balances.

How does Upromise Roundup work?

The Upromise Roundup feature rounds up your purchase total amount to the nearest dollar. It works with Upromise MasterCard and applies to $1 to $500 total purchase amount.

How do you maximize Upromise?

To maximize rewards with Upromise, apply for the Upromise MasterCard and use that to pay for your purchases.

Who bought Upromise?

Prodege, a marketing company, bought Upromise from Sallie Mae.

Can I receive a check for my rewards?

No, you can’t receive a check for your rewards. You’ll need to link a 529 college savings plan, checking, or savings account to get your rewards.