Quick Answer:

The best time to trade in your car is when you can get the most money out of it. It mostly depends on mileage, factory warranty, car age, and market conditions.

Key Takeaways:

- Assess Key Factors: Before trading in your car, evaluate its mileage, condition, warranty, and your financial situation to make an informed decision.

- Get the Best Trade-In Offer: Research your car’s market value, compare quotes from various dealerships, and negotiate to secure the best offer. Present your car in its best condition to positively impact its value.

- Choose a Reliable Dealership: Opt for a reputable dealership for a fair deal and efficient handling of the trade-in process.

Best Used Car Buyers

Peddle

Trustpilot Rating

Get a legit offer in minutes – provide VIN, mileage and condition

$0 fees + you don’t have to pay for towing – Peddle will take care of it

Get paid in check during the pick up for any car (damaged, junk)

Wheelzy

Trustpilot Rating

Quick car evaluation without the hassle – sell your car within 30 min

Choose a convenient date and time for free pick-up, even tomorrow

Get cash in hand the same day the Wheelzy agent picks up your car

1. Before the Mileage Exceeds 100,000 Miles

The rule of thumb is that a car with fewer miles is usually worth more because it’s presumed to have more life left in it. Vehicles under 100,000 miles are often considered in “average” condition, which can command a higher trade-in price.

Dealerships usually lower their offers significantly when the car exceeds 100,000 miles due to potentially expensive repairs of the engine, transmission, and other components.

2. Before the Factory Warranties Expire

After a factory warranty expires, all repair and maintenance costs fall on you. This can be expensive, depending on the age and condition of the car.

Cars still under warranty typically have a higher trade-in value, and once the warranty is expired, dealers have to take more risk into account, which often results in a lower offer for your car.

3. Before The Car Begins To Have Frequent Repairs

Financial experts suggest that car expenses, including loan payments, gas, insurance, maintenance and repairs, should not exceed 20% of your income.

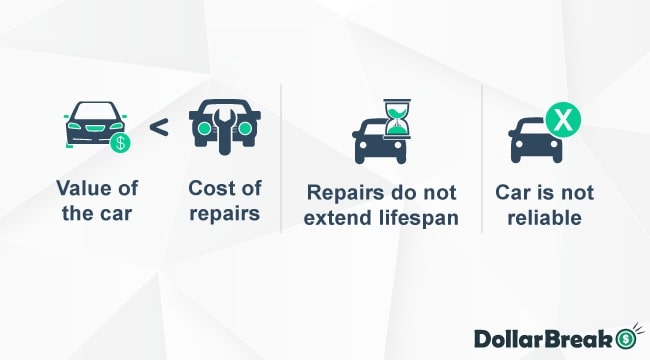

Calculate how much you spend on repairs each month and trade in a car if:

- Total car expenses exceed 20% of your income, and car repair costs make up the central part of it.

- Yearly car repair costs exceed the current market value of the car.

For example: if your car’s current market value is $5,000, and you spend $500 monthly to fix car issues (or $6,000 a year), trading in for a newer vehicle would be a financially better decision.

4. When You Have Equity In Your Car

If you have a loan, it is important to find out if you have positive or negative equity.

How to calculate equity:

Equity = Car’s Market Value – Outstanding Loan Balance

If the number is positive, your car is worth more than you owe, and trading in is financially beneficial.

If the number is negative, you owe more on the car than it’s currently worth. This means you will need to cover the difference between the trade-in value and the remaining loan balance yourself, so it’s not beneficial to trade in.

5. When the Market Conditions Are Favorable

Used cars are generally in higher demand towards the end of the year and in the early part of the year. This is because many people are looking for a vehicle before the winter months or after receiving a tax return.

Additionally, trading in your car before the new model release, which usually happens in the fall season, can also increase your offer value.

Best season to trade in depending on the car’s type:

- Convertibles, sports cars, and vans: spring and summer

- SUVs, trucks and 4-wheel drive cars – autumn and winter

6. When Your Lifestyle Changes

If you initially bought a compact car because it was fuel-efficient and perfect for city driving, but now you’ve started a family and need more space for car seats, strollers, and other gear, trading in for a larger vehicle, like an SUV or minivan, might be the best move.

Alternatively, you might have started with a larger vehicle for a daily commute but moved closer to work or have a job change that involves less driving and now prefer a smaller, more fuel-efficient car.

Another common scenario involves the need for different features or technology. Perhaps your current car lacks advanced safety features, such as lane-keeping assist or automatic emergency braking, and you want a car with these modern technologies.

Even if the trade-in offer for your current car isn’t the highest, the improved functionality or efficiency in your driving or associated activities, whether it’s increased fuel efficiency, additional space, or advanced features, can outweigh the monetary difference, thus offering overall greater value and satisfaction.

How Does Trading In Work?

Trading in a car involves exchanging your current vehicle at a dealership as partial payment for a new or used car.

It is a rather quick process, typically completed within a day or two. The exact timing depends on:

- How busy the dealership is

- Is your vehicle in demand

- Condition of your car

- If you have required paperwork

Determine Your Car’s Value

Understanding the value of your car before negotiating with the dealer gives you leverage and ensures you’re getting a fair trade-in offer.

The best way to check the car’s market value is via Kelley Blue Book car’s value calculator. It is a free online tool that uses factors such as the car’s make, model, age, mileage, and overall condition.

KBB’s database compares your car to similar vehicles in your region and provides a trade-in range that you might expect to receive from a dealership.

Research Dealerships

Different dealerships might offer significantly different trade-in prices, so it’s worth it to explore multiple options.

Brand

Dealerships often offer better trade-in prices for cars of the same brand because they specialize in selling those models. For example, if you’re trading in a Toyota, the same-brand dealership might offer a better price than a non-branded dealership.

Reputation

Always check online reviews, ratings, and testimonials that can give you an idea of a dealership’s customer service and fairness in trade-in deals.

If a dealership has numerous complaints, especially those related to the trade-in process or customer service experience, it may not be the best place to trade your car.

Competition

Consider visiting several car dealerships to obtain a variety of quotes. Gathering multiple proposals not only boosts your negotiating strength but also empowers you to use one dealership’s bid to challenge another, potentially motivating them to raise their trade-in valuation.

Compare and Choose Offer

Compare dealership offers and consider the total cost of the transaction:

- Price of the car you are buying

- The trade-in value of your vehicle

- Financing terms

- Car inspection fee

- Documentation fees

- Loan payoff fee

Trade-in Example:

You’re planning to trade in your well-maintained Honda Accord with the goal of purchasing a Toyota Camry.

Dealership A:

1. Offers to buy your Honda Accord for $16,000

2. Offers to sell you Toyota Camry for $24,000 with 6% APR for a five-year term.

3. Net Cost: $24,000 – $16,000 = $8,000

4. Total Cost: $9,280 (interest included)

Dealership B:

1. Offers to buy your Honda Accord for $15,000

2. Offers to sell you Toyota Camry for $24,000 with 3% APR for a five-year term.

3. Net Cost: $24,000 – $15,000 = $9,000

4. Total Cost: $9,703 (interest included)

At first glance, you might be tempted to choose Dealership B as they offer twice as low-interest rate. However, Dealership A is a better choice by $423 as the higher trade-in value outweighs the lower interest rate.

Best Online Dealership to Trade In Your Car

Trading at local dealerships has its advantages, like in-person communication and instant transactions, but it also tends to offer lower trade-in value.

Online trade-in companies, like Peddle, might be a better choice. They have lower overhead costs and a larger market reach, which results in higher offers for trade-ins.

Moreover, you will save time driving to local dealerships and negotiating in person. For example, trading in a car to Peddle will take no more than 30 minutes, the car will be picked up for free from your driveway, and the company will take care of all the paperwork for you.

Pros and Cons of Car Trade In

| Advantages | Disadvantages |

|---|---|

| Buying car at the same time as selling | Low trade-in value offers |

| Quick paperwork process | Need experience in negotiating |

| Potentialy reduced sales tax | Cleaning and detailing the car |

| Option to sell financed car | Need to spend time visiting multiple dealers |

| Down payment assistance programs | Not all lots will accept your car |

People Also Asked

Do you lose a lot of money trading in a car?

When trading in, you should expect to get no more than the car’s wholesale value, so dealership offers can be significantly lower than the retail price you would get selling the car.

How much you lose depends on :

- Your car’s make, model, year

- Your car’s mileage and condition

- Your car’s demand

- Value of the vehicle you want to buy

- Trade in terms

Can I trade in a car with problems?

There is no law stating you can not trade in a car with mechanical problems, but it will lower your car’s trade-in value.

You must disclose any issues to the dealer before completing the trade-in.

Can I trade in a car I just bought five months ago?

There are no restrictions to trade in a newly purchased car, but it might be a financially bad decision.

If you buy a brand-new car, its value depreciates the most in the first few years, and trading it in will cause you to lose money.

If you bought a used vehicle, trading in as soon as five months should not be a financially bad decision.

Will trading in my car hurt my credit?

Trade in the car to a well-trusted dealership company should not affect your credit score.

However, if you trade in a financed car and the dealership fails to transfer money to the lender to pay it off your credit score can drop due to missed payments.

Is it better to clean your car before trading it in?

Dealership staff usually takes care of cleaning the car before putting it up for sale.

However, if you fix minor issues, wash the car and clean the interior before visiting the dealership, you might get a better offer.

What affects car trade-in value?

- Car’s make, model and age

- Car’s mileage and condition

- Maintenance history

- Equipment

- Current demand

- Accident history

What if my trade-in is worth more than the new car?

If your trade-in offer is higher than the price of the car you are buying dealer will transfer the difference to your account.