If you’re looking for a simple and effective way to save money and better manage your finances, Rocket Money might be the app you’ve been waiting for.

In this comprehensive review, we’ll explore how Rocket Money works, the various features it offers, and the potential savings you can expect. We’ll also compare Rocket Money to other popular money-saving apps and discuss the safety and security measures in place to protect your sensitive financial information.

By the end of this review, you’ll have a clear understanding of whether Rocket Money is the right choice for optimizing your spending and reaching your financial goals.

Key Takeaways:

- Rocket Money offers a range of money-saving features, including subscription monitoring, bill negotiation, and outage refunds, helping users save an average of $512 per year.

- The app is free to download, with optional premium services starting at $4.99 per month or $35.99 per year, providing additional benefits such as unlimited budgets and a cancellations concierge.

- Rocket Money prioritizes data privacy and security, using bank-level 256-bit encryption, Plaid for secure financial institution connections, and Amazon Web Services for hosting.

Rocket Money Review

Rocket Money is a money management app that aims to help users reduce their spending and save money. To date, the company has helped over 2 million members save over $1 million. Some of the ways that the app helps users reduce their spending include canceling unused subscriptions, negotiating your bills to lower them and more. According to the company, users can save up to $550 per year or more.

Pros

- No upfront costs – you don’t need to pay upfront and only pay a fee when they help you save. Or, you can get the premium plan for $4.99 per month.

- High potential to save money – on average, most of the platform’s users can save an average of $96 per year or more by using the platform’s tools.

- 5+ different ways to help you save money – including tracking and understanding your credit score, pay advance, budgeting, negotiating bills and more.

- Save money by canceling subscriptions – most users realize that they have 1 or 2 unused subscriptions once they consolidate everything on one page.

Cons

- High fees – if the platform is able to help you save any money, they will charge a high fee of 40%. However, this may still be better than not saving.

- Access to sensitive information – you will need to provide information such as your bank account and transactions to a 3rd party to use the platform.

Jump to: Full Review

Compare to Other Money Saving Apps

Swagbucks

18 ways to earn money – surveys, coupons, cashbacks + $5 sign up bonus

Up to 10% cashback from stores – Walmart, Amazon, Best Buy, JCPenney

Most members can earn an extra $50 – $200 a month using Swagbucks

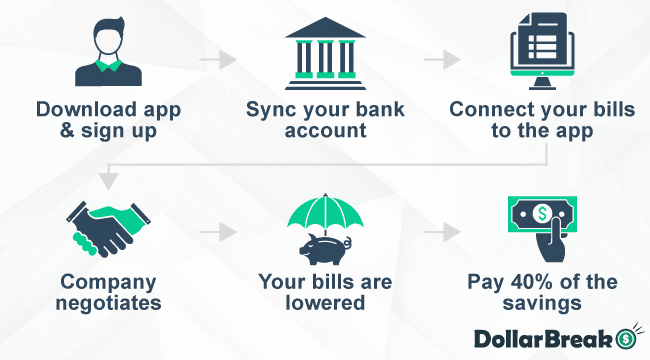

How Does Rocket Money Lower Bills?

According to Rocket Money, it is an app that “Makes it easy to optimize your spending, manage subscriptions, lower your bills, and stay on top of your financial life.”

Easy money can sound too good to be true. Can an app really help you save a substantial amount of money?

Rocket Money has a range of features that aim to help you get your finances in order. According to Debt.com, only around one-third of Americans keep a household budget, so it’s no wonder so many people are looking for ways to cut back on spending.

The services offered by Rocket Money can help you manage your finances better without the emotionally taxing process of going through them thoroughly. Most of us would jump at the chance to earn an extra $512 a year, so is Rocket Money the solution to help you achieve that goal?

Lower My Bills

With the ‘Lower My Bills’ feature, Rocket Money negotiates down your bills. They have direct negotiations with a range of service providers, such as AT&T and Verizon. With this feature, if they can’t negotiate down your bill, you don’t pay any cost. However, if they save you some money, they take 40% of the savings.

The feature is easy to use. You simply connect your bill by taking a photo or logging into your account. Their expert negotiators then start working on your behalf. They will never remove features or services to lower your bill and will ensure that you get the same service or subscription but simply for a better rate.

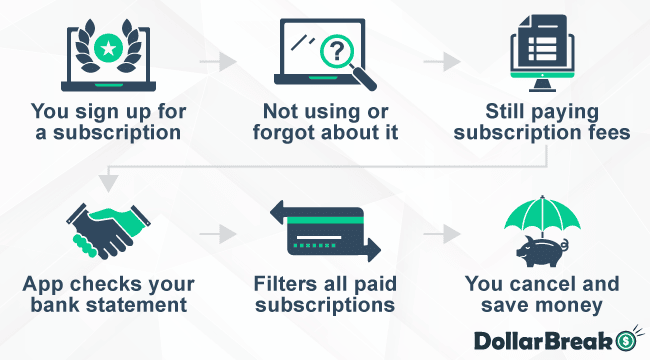

Subscription Monitoring

We are all guilty of signing up for too many online subscriptions. In fact, according to West Monroe, 84% of Americans underestimate what they spend on subscription services. You might have a bunch of streaming subscriptions, multiple music subscriptions, or signed up for free trials for things you only used once and then forgot to cancel.

Rocket Money shines a light on all these subscriptions. Like most people, you probably don’t closely monitor your bank account. Rocket Money pulls all your subscriptions and puts them in one easy-to-review recurring charges page. The results can sometimes be shocking. You may have to face the unpleasant reality that you are forking out hundreds of dollars a month for subscriptions you aren’t using.

Seeing this information all in one quick-to-review location can make you take stock of your spending habits. You may change your financial behavior and tread more cautiously in the future with signing up for subscription services.

With this information, you can cancel subscriptions you don’t need, and with the premium version of Rocket Money you can do this from within the app with a simple ‘Cancel service’ button.

Alternatives to Rocket Money

There are a few other companies out there offering services similar to those of Rocket Money. Trim and Billshark are two of the more popular ones.

Trim

Trim is an app with a similar offering that charges 33% of your savings. While this is less than Rocket Money, it does not have access to as many subscription services to cancel and it will not request bank fee refunds.

Here are some other key differences:

- Trim has a free service for canceling subscriptions, whereas Rocket Money requires a premium subscription

- Trim includes a debt payoff program that costs $10 per month

- Trim does not have a free app for iOS or Android

Billshark

Billshark is an app that helps you lower your bills, such as cable, internet, cell service, etc. It charges 40% of your savings, the same as Rocket Money.

How Much Does Rocket Money Cost?

Rocket Money offers a range of services at different costs. The app is free to download, but there are several optional additional services that cost a fee.

Rocket Money Premium

Premium services include Balance Syncing, Premium Chat, Cancellations Concierge, Custom Categories, Unlimited Budgets, and Smart Savings. The premium option costs $35.99 a year or $4.99 billed monthly.

Bill Negotiation

Bill negotiation is charged based on the amount that the negotiators can save you. The success fee is 40% of the first year’s savings.

Outage Refunds

Occasionally, Rocket Money can get you an outage refund for when services go down. Like bill negotiations, they will take 40% of the refund you receive.

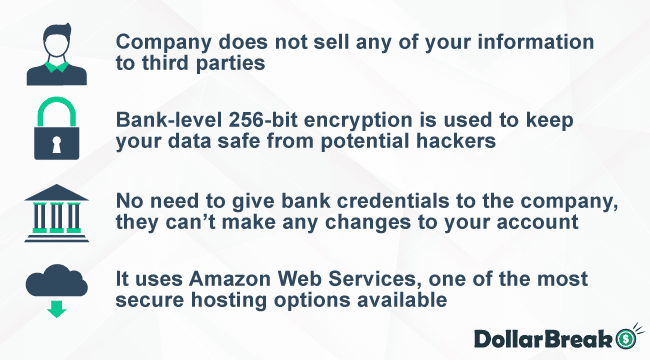

Is Rocket Money Safe to Use?

Data privacy is important, especially when you are letting an app access all your financial information. You want to know that your information is safe and will not be sold on or stolen. When using any app that needs your personal data, you should proceed with caution.

Rocket Money understands that data privacy is important. It does not sell your information to third parties. It also uses bank-level 256-bit encryption to keep your data safe from potential hackers.

In addition, Rocket Money uses Plaid to connect with financial service institutions. You do not need to give Rocket Money your bank credentials, and they cannot move money or make any changes to your account.

It uses Amazon Web Services for its hosting. This is one of the most secure hosting options available and is used by the Department of Defense, NASA, and the Financial Industry Regulatory Authority (FINRA).

What Does This Rocket Money Review Tell You?

With so many Americans unaware of what they are spending on subscription services, Rocket Money is an app that will be helpful for many. The different subscription options make it easy to pay only for the features you need, and having the app on your phone gives you a convenient way to see where your money is being spent.

The insights it will give you into your spending will help you change your spending habits and build a clear picture of where your money is going. From here you can set out a more structured plan for your financial future and put a clear budget in place.

The app is free to download, so it is worth starting with the free service and upgrading if you feel it’s necessary. As you become more familiar with the service and get to grips with its features, you may feel the advantages of having premium are worth paying for, in which case you can upgrade.

Rocket Money FAQ

What Is Rocket Money?

Rocket Money is an app available on iOS and Android. It helps users identify where they are spending and cut out unnecessary bills. For example, you may have a Hulu subscription that you have never used. You signed up months ago to watch the new season of The Handmaid’s Tale and forgot to cancel it. Now, it’s taking $6 out of your account every month.

Rocket Money will flag up any recurring bills coming out of your bank, put them in an easy-to-monitor screen and let you assess which ones to keep and which ones to cancel. It has a bunch of other helpful features, like negotiating down your bills and monitoring for outage refunds.

Syncing your bank account is easy, and it doesn’t require you to provide any of your banking credentials to the app. The interface is intuitive and having your finances presented in this way can help you catch on to where you are frequently spending money. Yee, your Starbucks addiction is included! In addition, the app can send you notifications when there is a change in your bill and will give you the option to have a negotiator try to lower it on your behalf.

According to Rocket Money’s founder, it has helped save an average of $512 per year, with 250,000 people signing up.